Real estate values resume their upward trend

After a brief pause at the beginning of the year, East Bay home prices are increasing again in 2023

After pausing for a few months in the first three months of this year, East Bay residential real estate values show a resumptive trend of increasing values. With one rare exception, an analysis of …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Real estate values resume their upward trend

After a brief pause at the beginning of the year, East Bay home prices are increasing again in 2023

After pausing for a few months in the first three months of this year, East Bay residential real estate values show a resumptive trend of increasing values. With one rare exception, an analysis of the first six months of 2023 also shows a substantial decrease in the number of sales in almost all nine cities and towns in this region.

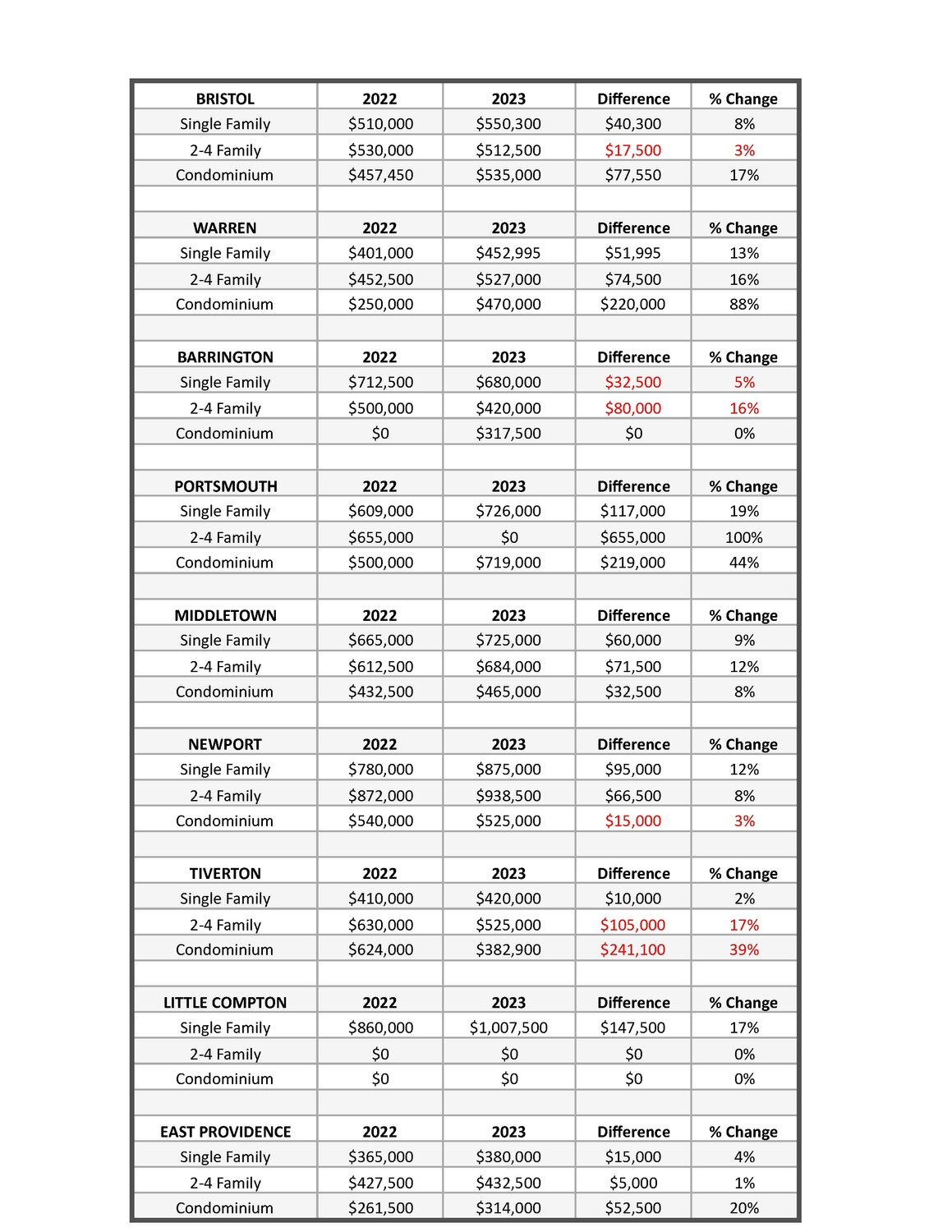

As the accompanying chart shows (both above and below), most values continue to climb in all sectors of the residential market — single-family, 2- to 4-family and condominiums.

It is interesting to note that the decline in single-family units sold ranges from 40% in Warren, to 11% in Middletown, with an average decline in single-family units sold throughout the East Bay at 27%.

On the value side, the median price of Portsmouth single-family homes increased 19%, for the highest gain in the region, where there was an average of 8.8% price increases throughout the East Bay. Barrington prices slid 5%, making it the only town in the East Bay to decline.

As I described in an earlier column (April 12-13), the market is still largely frozen, as those homeowners who have locked in 2.5%-3.5% mortgage rates during the past few years sit on the sidelines until rates begin to decline.

What is interesting is that the Days on Market (DOM), with some exceptions, are largely unchanged, even though the units sold has decreased rather dramatically.

A shortage of inventory

Inventory is historically low. For example, the Bristol condo market currently has nine units offered for sale, of which six are pending sale, leaving only three units actively for sale, a remarkably low number, and all three have been on the market for less than 30 days.

Last month’s report on U.S. inflation shows that the Federal Reserve’s interest rate increases over the past year have resulted in inflation finally coming down substantially, from a high of 9% a year ago to the current 3% range. The Fed’s next move on interest rates will either exacerbate owners’ reluctance to sell by raising rates higher or by keeping the rates the same. It is unlikely that a drop in interest rates is probable in 2023, unless there is overwhelming evidence that inflation is in the Fed’s target range of 2%.

Looking ahead

So, what will happen next? Based on the recent positive inflation news, notwithstanding any catastrophic changes, like another pandemic or spread of the Ukraine war into Europe, I think we can expect the Fed for the short term to keep increasing rates at small intervals until they choke down the housing market price increases. It is a conundrum, because as the Fed continues to increase rates, homeowners with low interest rates will continue to sit on the sidelines, inventory will remain historically low and likely home prices will continue to increase, as we can see from the data of this years first six months compared to last year’s same six months.

Personally, I think we can expect the Fed to hold a steady course through 2023 and then start to reduce rates in 2024, which will then start to motivate homeowners with low mortgage rates to start selling their homes and buying different housing opportunities, which will then increase supply and hopefully slow down the price increases. I believe the magic number to move owners from the sidelines to active sellers will be in the 4% +/- range.

I have been through enough of the housing gyration ups and downs over the past three-plus decades to know that slow and steady is the best thing for the housing market, as steep inclines have led in the past to steep declines. We are all better off with the former rather than the latter.

Douglas Gablinske owns AppraiseRI, a 27-year-old real estate company located in Bristol, RI. He is Chairman of the Warren Taxpayer Appeal Board and was recently appointed to serve on the RI Real Estate Appraisal Board. He can be reached at Doug@AppraiseRI.biz

Comparing 2022 and 2023 – Prices rise in most communities

|

BRISTOL |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$510,000 |

$550,300 |

$40,300 |

8% |

|

2-4 Family |

$530,000 |

$512,500 |

$17,500 |

3% |

|

Condominium |

$457,450 |

$535,000 |

$77,550 |

17% |

|

WARREN |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$401,000 |

$452,995 |

$51,995 |

13% |

|

2-4 Family |

$452,500 |

$527,000 |

$74,500 |

16% |

|

Condominium |

$250,000 |

$470,000 |

$220,000 |

88% |

|

BARRINGTON |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$712,500 |

$680,000 |

$32,500 |

5% |

|

2-4 Family |

$500,000 |

$420,000 |

$80,000 |

16% |

|

Condominium |

$0 |

$317,500 |

$0 |

0% |

|

PORTSMOUTH |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$609,000 |

$726,000 |

$117,000 |

19% |

|

2-4 Family |

$655,000 |

$0 |

$655,000 |

100% |

|

Condominium |

$500,000 |

$719,000 |

$219,000 |

44% |

|

MIDDLETOWN |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$665,000 |

$725,000 |

$60,000 |

9% |

|

2-4 Family |

$612,500 |

$684,000 |

$71,500 |

12% |

|

Condominium |

$432,500 |

$465,000 |

$32,500 |

8% |

|

NEWPORT |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$780,000 |

$875,000 |

$95,000 |

12% |

|

2-4 Family |

$872,000 |

$938,500 |

$66,500 |

8% |

|

Condominium |

$540,000 |

$525,000 |

$15,000 |

3% |

|

TIVERTON |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$410,000 |

$420,000 |

$10,000 |

2% |

|

2-4 Family |

$630,000 |

$525,000 |

$105,000 |

17% |

|

Condominium |

$624,000 |

$382,900 |

$241,100 |

39% |

|

LITTLE COMPTON |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$860,000 |

$1,007,500 |

$147,500 |

17% |

|

2-4 Family |

$0 |

$0 |

$0 |

0% |

|

Condominium |

$0 |

$0 |

$0 |

0% |

|

EAST PROVIDENCE |

2022 |

2023 |

Difference |

% Change |

|

Single Family |

$365,000 |

$380,000 |

$15,000 |

4% |

|

2-4 Family |

$427,500 |

$432,500 |

$5,000 |

1% |

|

Condominium |

$261,500 |

$314,000 |

$52,500 |

20% |

An analysis of real estate sales in the first six months of 2022, compared to the first six months of 2023, shows that prices rose in nearly every East Bay community, with a high of 19% in the Portsmouth single-family market, followed closely by Little Compton at 17%.