How much would a new high school cost Bristol?

A look into how much a proposed $200M bond to build a new high school and fix other schools throughout the district.

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

How much would a new high school cost Bristol?

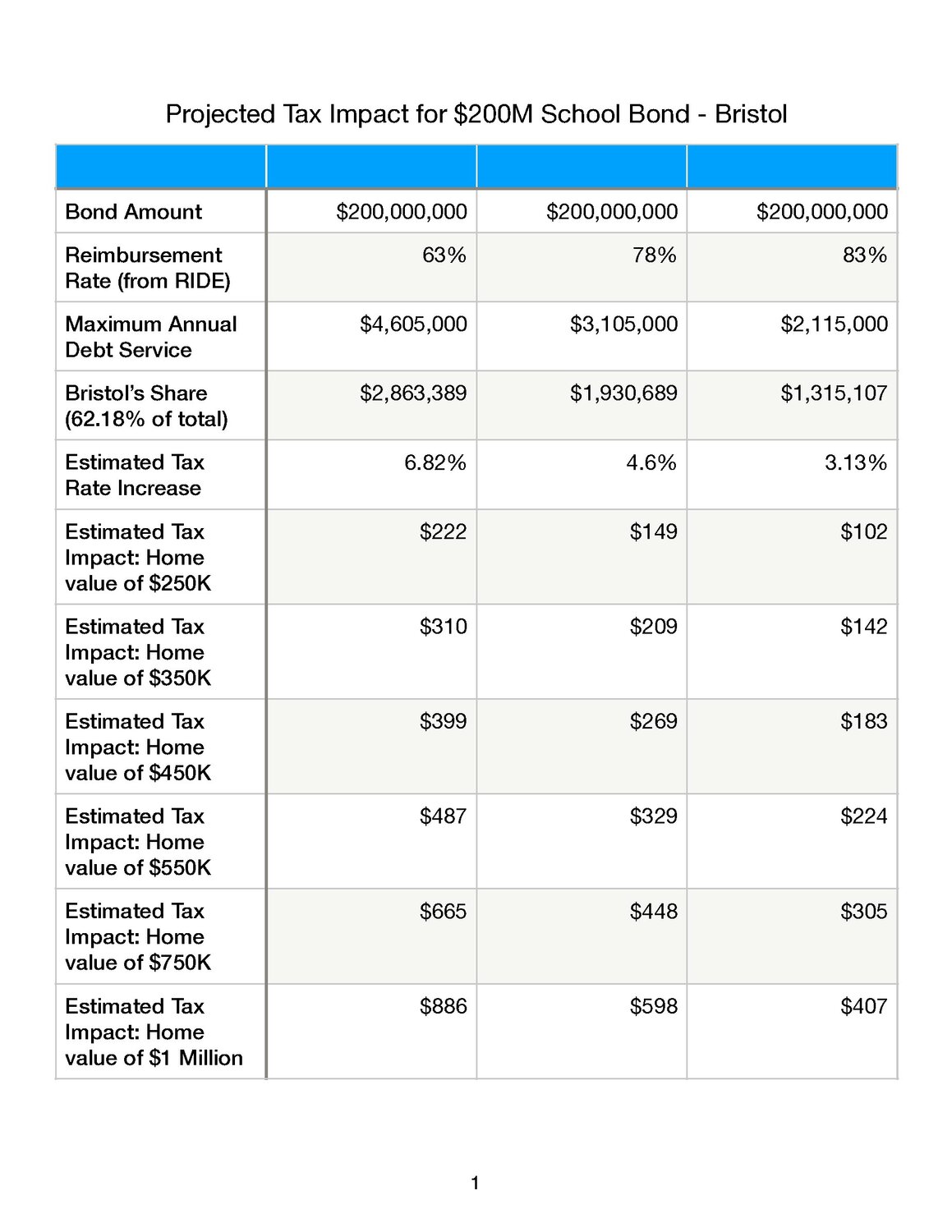

New financial projections reveal that, assuming a maximum reimbursement rate from the state, a school construction bond of up to $200 million that will be voted on a little more than a month from now would still have a measurable impact on Bristol’s budget, and Bristol taxpayers.

However, Town Administrator Steven Contente (who also sits on the School Building Committee) said in an interview on Tuesday it is an impact the Town is capable of handling without an undue burden being placed on Bristol taxpayers.

“I’m in support of the bond. I’m going to vote for it, and I think we’re going to be able to absorb this,” he said. “This is a once in a generation opportunity.”

Updated tax impact projections — released by the Bristol Warren Regional School District following the submission of their Stage 2 application to the Rhode Island Department of Education (RIDE) on Sept. 15 — show that with a maximum possible reimbursement rate of 83% (meaning, the state ultimately pays for 83% of the project), the Town of Bristol would require the equivalent of a 3.13% tax increase over last year’s budget in order to finance the first principal and interest payments for those bonds when they come due; which does not include all of the other typical spending increases for salaries, benefits, purchases and more.

For a home worth $350,000 in Bristol, that would translate to a $142 increase in annual property taxes; for a $450,000 home, it would mean a $183 increase; and a $550,000 home would see an increase of $224 (see the accompanying chart for more financial data).

Warren would be responsible for 37.82% of the total debt service, with Bristol picking up the remaining 62.18%. Assuming a maximum reimbursement rate of 83% from the state, Bristol would be responsible for $1,315,107 in annual debt service from the bond, with Warren’s annual share of that debt service amounting to $799,893.

Reimbursement rate is key

A crucial factor in these numbers focuses on the reimbursement rate that RIDE will utilize to repay Bristol Warren for school capital projects once they are completed. The minimum rate for the district is 63%, but Superintendent Ana Riley was confident in a recent interview discussing the projections that they are on track to receive 20% in additional bonuses, which would bring their reimbursement rate up to a maximum of 83%.

Those bonuses are awarded after projects are completed, and are only granted if they are proven to adhere to various criteria set forth by RIDE, such as improving the efficiency, safety or educational offerings of the schools that utilize bond money. Riley said the plans submitted to the state should qualify for a total of five of those bonuses, but they only need four to get to the 20% maximum bonus.

RIDE does not officially announce what the final reimbursement rates are until they have approved Stage 2 applications in December (after the November election when voters will be deciding on this bond), but Riley said the state is also aware of that troubling conundrum.

“What RIDE has said they will do for those towns that are going to ballot in November is review our Stage 2 [application], and if what they see preliminarily stays the same, then they project we would be eligible for those bonus points,” she said. “They’re willing to put that in writing. So we’re trying to get that so we can use it as part of our FAQ to voters prior to the election, which says that RIDE believes if we follow our plan, we’re eligible for the full 20%. And we do think we’ll get the full 20%.”

The differences between a 63% and an 83% reimbursement rate are significant. Should the district only secure the minimum reimbursement rate, the maximum annual debt service between the two towns more than doubles over the course of the 30-year bond period, from $2,115,000 to $4,605,000. The expected tax impact in Bristol would go from $183 for a $450,000 home to $399, with the total tax levy increase necessary going from 3.13% to 6.82% over FY23 numbers.

For context, state law limits municipalities to a 4% increase in their tax levy any given year. To go higher requires approval from the General Assembly.

Debt coming off the books will help

Contente said a large factor in his optimism about the affordability of the bond is the fact that in 2027, Bristol will be paying off the last bit of a $30 million bond that was approved in 2006.

“Right now Bristol pays $400,000 a year in debt service, which is our only debt service, and it drops off,” he said. “That $400,000 being paid off is going to provide some relief to the taxpayers.”

Doing some quick calculations, Contente said that given an 83% reimbursement, the total tax impact would be reduced from 41 cents per $1,000 of property value for residents to just 29 cents per $1,000 with the new bond.

School District finance director Danielle Carey said that the preliminary plan is to utilize bond anticipation notes (BANs) for short-term financing prior to going out for the full bond some time in FY27 to fund the full-scale construction of the new high school and higher-cost projects at other schools — which Contente agreed would decrease the financial burden of the bond early on.

If the process indeed occurs on that timeline, the first interest payments for the bond would be due in FY27, and the first full principal and interest payment in FY28. But if they go out to bond earlier, the payments would also be due earlier. All projects must be completed by June 30, 2028, in order to receive reimbursement.

What’s the alternative?

For Contente, perhaps the most compelling reason for his support of the bond revolved around pondering the alternative if they don’t grab the money now with a guaranteed (and likely not to be seen again for a long time) reimbursement.

“It looks like we’re going to be getting back about $166 million from the state. So we [Bristol and Warren] have to come up with $34 million,” he said. “If we don’t take this deal, we’re still going to have to find about $30 million in repairs for those schools…We’re going to spend the money regardless. If this fails, they’re going to look to go out for another multimillion bond to do only those limited, most urgent repairs.”

Contente said that it wouldn’t make sense to spend a similar amount of total money only to make repairs without fixing the school’s underlying issues.

“The other big part of this is they’re going to make the school energy efficient. They’re talking about geothermal heating systems…There’s even savings there,” he said. “The building they have there now is not energy efficient.”

Contente said that budgeting for the large expense will take some effort, but it’s an effort worth making as an investment towards the betterment of the student population and the community at large.

“I think we run pretty lean…Will we have to make some cuts, or delay some things? Probably. But it’s an investment,” he said. “I’m convinced. Where we are now, there’s nothing we can do about it. We need to make significant, long-term investments in the schools for the future so they’re good learning environments and they’re efficient. We’re going to spend the money anyways. I would prefer to get the money from the state of Rhode Island and do it right, rather than us turn the money down and end up spending the money anyways.”