How much will a new high school cost Warren?

Part one of a series into the proposed $200M school bond in Bristol Warren looks at the tax impact that would be experienced in both communities if the bond passes in November.

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

How much will a new high school cost Warren?

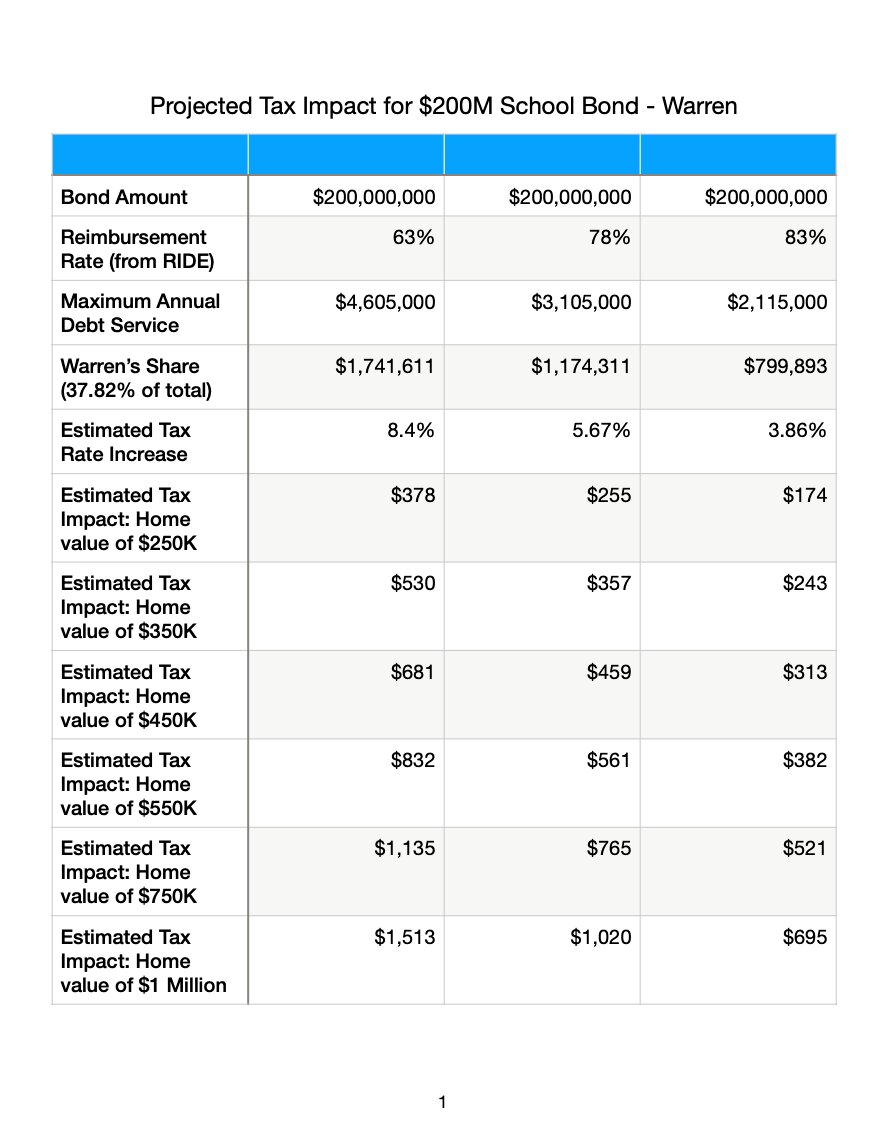

New financial projections reveal that even with a maximum reimbursement rate from the state, a school construction bond of up to $200 million would have a significant impact on Warren’s budget, and Warren taxpayers. That bond will be voted on a little more than a month from now.

Updated tax impact projections — released by the Bristol Warren Regional School District following the submission of their Stage 2 application to the Rhode Island Department of Education (RIDE) on Sept. 15 — show that even with a maximum possible reimbursement rate of 83% (meaning, the state ultimately pays for 83% of the project), the Town of Warren would still require the equivalent of a 3.86% tax increase over last year’s budget in order to finance the first principal and interest payments for those bonds when they come due; which does not include all of the other typical spending increases for salaries, benefits, purchases and more.

For a home worth $350,000 in Warren, that would translate to a $243 increase in annual property taxes; for a $450,000 home, it would mean a $313 increase; and a $550,000 home would see an increase of $382 (see the accompanying chart for more financial data).

Warren would be responsible for 37.82% of the total debt service, with Bristol picking up the remaining 62.18%. Assuming a maximum reimbursement rate of 83% from the state, Warren’s annual share of that debt service would amount to $799,893, while Bristol would be responsible for $1,315,107.

There are a few further pieces of context to keep in mind when looking over these numbers.

Reimbursement rate is key

A crucial factor in these numbers focuses on the reimbursement rate that RIDE will utilize to repay Bristol Warren for school capital projects once they are completed. The minimum rate for the district is 63%, but Superintendent Ana Riley was confident in a recent interview discussing the projections that they are on track to receive 20% in additional bonuses, which would bring their reimbursement rate up to a maximum of 83%.

Those bonuses are awarded after projects are completed, and are only granted if they are proven to adhere to various criteria set forth by RIDE, such as improving the efficiency, safety or educational offerings of the schools that utilize bond money. Riley said the plans submitted to the state should qualify for a total of five of those bonuses, but they only need four to get to the 20% maximum bonus.

RIDE does not officially announce what the final reimbursement rates are until they have approved Stage 2 applications in December (after the November election when voters will be deciding on this bond), but Riley said the state is also aware of that troubling conundrum.

“What RIDE has said they will do for those towns that are going to ballot in November is review our Stage 2 [application], and if what they see preliminarily stays the same, then they project we would be eligible for those bonus points,” she said. “They’re willing to put that in writing. So we’re trying to get that so we can use it as part of our FAQ to voters prior to the election, which says that RIDE believes if we follow our plan, we’re eligible for the full 20%. And we do think we’ll get the full 20%.”

The differences between a 63% and an 83% reimbursement rate are significant. Should the district only secure the minimum reimbursement rate, the maximum annual debt service between the two towns more than doubles over the course of the 30-year bond period, from $2,115,000 to $4,605,000. The expected tax impact in Warren would go from $313 for a $450,000 home to $681, with the total tax levy increase necessary going from 3.86% to 8.4% over FY23 numbers.

For context, state law limits municipalities to a 4% increase in their tax levy any given year. To go higher requires approval from the General Assembly.

When will this impact actually hit taxpayers?

District finance director Danielle Carey said that the preliminary plan is to utilize bond anticipation notes (BANs) for short-term financing prior to going out for the full bond some time in FY27 to fund the full-scale construction of the new high school and higher-cost projects at other schools.

If that indeed occurs on that timeline, the first interest payments for the bond would be due in FY27, and the first full principal and interest payment in FY28. But if they go out to bond earlier, the payments would also be due earlier. All projects must be completed by June 30, 2028, in order to receive reimbursement.

Also important to note is that these financial projections are based on each town’s last completed fiscal year (FY23; July 1, 2022 to June 30, 2023) and the FY23 tax levy, which creates additional considerations.

If the major bond funds are staggered and not sought until FY27 as expressed above, Riley and Carey reasoned that Warren effectively has three more budget cycles to begin to account for the increased cost of the bond, lessening the impact when it does come due.

“Since I’ve been here the last two fiscal years, Warren has [increased its tax levy] 4% both years,” said Riley. “It doesn’t mean that expenses don’t change in the town, and if they didn’t raise taxes from now until FY28, [these projections] would be what they have to do to get there.”

Riley reasoned that if Warren were to continue to raise taxes during the next few budget cycles to prepare for this foreseen expense, the impact of that first payment would be significantly reduced. She did acknowledge, however, that other cost increases (contractual and otherwise) would still need to be accounted for.

While acknowledging the budgetary uncertainty baked into the whole process, Riley offered perspective of what could be gained in Warren by having a modern school system with updated facilities.

“I don’t know where [Warren will] be [financially] in the next few years. Is four years enough to get them there to where they have enough space for what they need to do and what they’d like to do, so we’re not kind of crushing that opportunity for them?” she said. “We are still giving them an asset and a positive source of enhancement for the town. Because we are making improvements to both the elementary school and the middle school, which does draw families to the community.”

Local takes

For some local leaders in Warren, the proposition of passing the school bond and handling its financial implications feels a bit like being between a rock and a hard place.

“Our capital budget is going to have to just be decimated, and the things that are the most fringe extras, like grants and contributions, may have to just go on pause or be scrubbed. But I don’t know … This has to happen. We have to make this investment; otherwise we’re just showing no faith in our future,” said Town Councilor Keri Cronin. “I really don’t know. It is going to be an absolute cut-to-the-bone, and beyond, budget. Which is what we’ve been doing. We have not passed an unreasonable budget in a very long time. We are getting the most out of what very little we have. It’s going to take some pretty serious compromises.”

Council President John Hanley, who has been vocal about his concerns of cost overruns occurring in other municipalities that have gone to bond for school constructions, echoed much the same sentiment.

“It’s kind of a double edged sword. We do need to do something with our schools, but we don’t want to price people out of their homes,” Hanley said. “For Warren, we’re going to have to make some cuts on the municipal side of the budget to offset that some way.”

Hanley mentioned the likelihood that the Town would have to exceed the 4% tax levy cap, and possibly pare back on things like road repairs and other infrastructure projects in town. He said he expects the school department to tighten its budgets in the coming years as well.

“Everyone is going to have to sharpen their pencils, because the taxpayers are going to feel this whether it’s the best case or the worst case scenario,” he said.

All of that said, both Hanley and Cronin said that they still support the bond initiative due to the clear need to fix up the schools.

“We do need the infrastructure in our schools, and we’ve neglected them for a long time. We just have to be extremely prudent on what we do,” Hanley said. “At the last Town Council meeting, I said to the superintendent, ‘you better keep your eye on overruns. I sit on the [Joint Finance Committee], and if you come back asking for more money, I’m going to do everything I can not to give it to you.’ ”

Cronin said the alternative of continuing to temporarily fix deficiencies within the schools would be doing a disservice to students, and amount to a worse financial decision in the long run.

“I truly believe it would be irresponsible not to support this and hope that this passes, because the fact of the matter is that the education of our students is among our top priorities, and the bottom line is that the facilities we have right now are below par and not sustainable,” Cronin said. “There are issues structurally within all the buildings, and most importantly within the high school, that it is beneath us to continue to send our students there. We can project the costs of all the bandaid fixes for the next 10 years…We know we’re going to be spending stupid money if we don’t just build a new high school.”