- SATURDAY, APRIL 27, 2024

The trends continue: Fewer sales, higher prices

Month after month, quarter after quarter, real estate prices continue to rise — and so do rents

The East Bay residential real estate trend of decreasing housing units sold and decreasing days on market, driven by the Fed’s action to increase rates, continues unabated. Homeowners are …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

The trends continue: Fewer sales, higher prices

Month after month, quarter after quarter, real estate prices continue to rise — and so do rents

The East Bay residential real estate trend of decreasing housing units sold and decreasing days on market, driven by the Fed’s action to increase rates, continues unabated. Homeowners are unwilling to sell their properties for other real estate opportunities, given many are locked into 2.5%-3.5% mortgage rates.

Since March of 2022, the Feds have increased the interest rate 11 times, though they paused the rate increase twice since the beginning of the rate increase cycle, including last month. A conventional, 30-year mortgage rate now stands at 7.25-8.25%.

It is completely understandable why homeowners are staying put; the math tells the story. A $300,000 mortgage, principal and interest payments, based on a 30-year loan at 3%, is $1,275 per month. That same $300,000 mortgage, at 8% interest, is $2,201, a monthly increase of $926.

Property values keep rising

Conversely, real estate values continue to climb, as they have for the past few years, and to all-time highs. Sellers are firmly in the driver’s seat, and one thing I know about sellers after almost 40 years in the residential real estate business as a broker, builder, developer, appraiser and a seller, is when sellers are in this position, they go for the jugular and extract every cent they can from the transaction, without remorse.

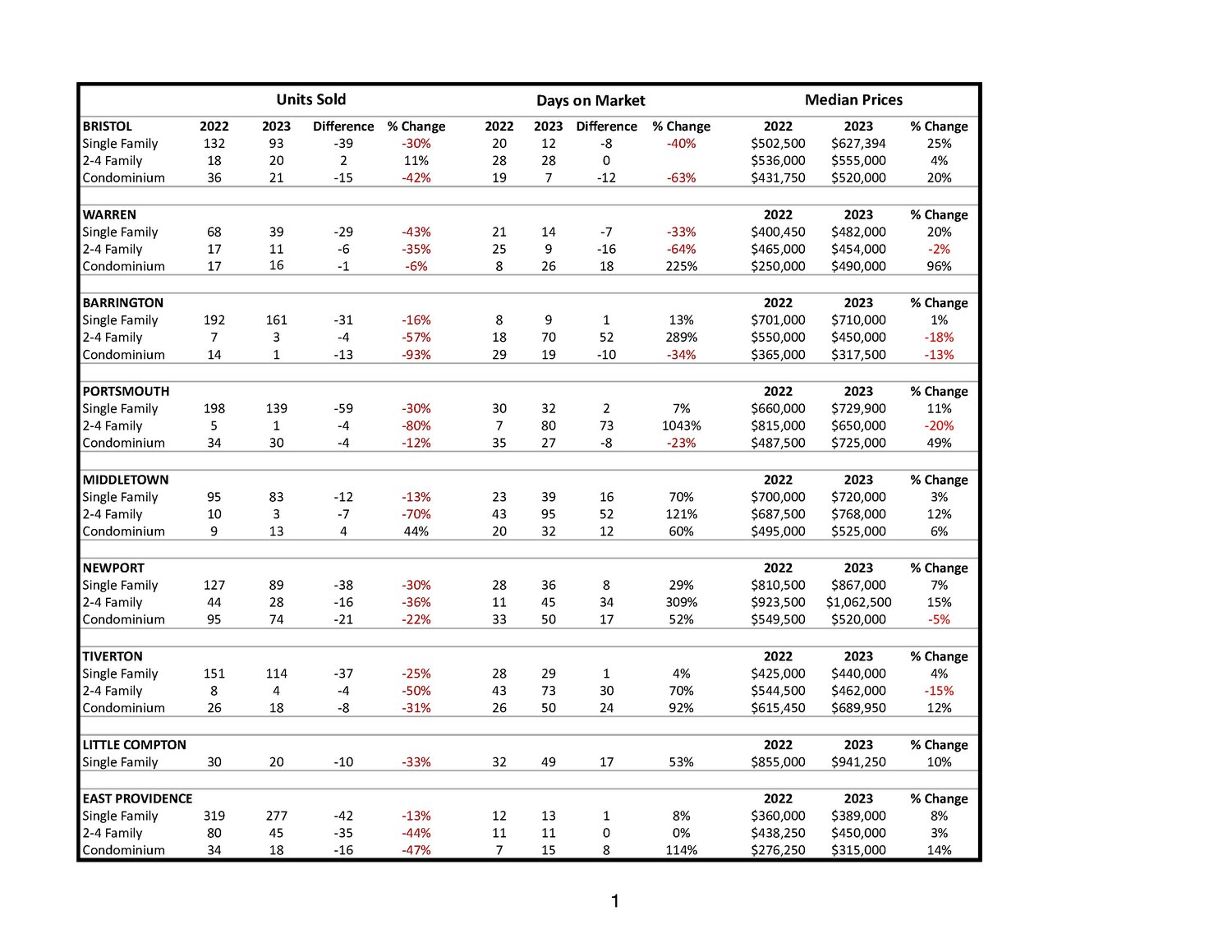

While these trends continue, there are differences between the individual cities and towns. I caution readers that the accompanying charts reflect the first nine months of 2023, compared to the first nine months of 2022, which is a small time frame for data comparison, but it is nevertheless worth a review to discern what the market is doing at this point in 2023.

Bristol and Warren see biggest increases

In the single-family category, Bristol and Warren, adjacent communities in the heart of the East Bay, are leading the way in sale price increases — Bristol by a whopping 25%, to a median price of $627,400, and Warren with a 20% increase to $482,000. Again, I caution readers that these numbers can be somewhat misleading, and by way of comparison, if I look back at year over year for Bristol, meaning September of 2023, back one year, compared to one year prior, to September of 2022, the median is about $550,000 in Bristol. We’ll know better where it all settles when I compare a full 2022 year with a full 2023 year.

Barrington, Tiverton and Middletown had the lowest single-family value increases, with all three under 4%. Portsmouth, Newport, Little Compton and East Providence were in the middle of the pack, with increases ranging from 7% to 11%.

Condo prices rising too

The condominium market is trending much the same way as single-family homes. Seven of the East Bay communities show condo price increases, except for Barrington and Newport. Barrington’s condo dataset is too small to point to any meaningful trend, and Newport price is off by only 5%.

Mutli-family prices also increasing

The 2-4-family real estate market in the East Bay also continues an upward trajectory. The bulk of 2-4-family homes are in East Providence, Newport, Bristol and Warren. Three of those four communities had an increase in the median price, except for Warren, which declined just 2%. These price increases have been followed by large rent increases for those who rent apartments or homes. It should also be noted that Newport now has the highest 2-4-family median price in the state, at more than $1 million, followed by the East Side of Providence, at $745,000.

Rising rents are a problem

The increases in rents over the past three to four years have been nothing short of astounding and unfortunate. Increases in weekly pay have also increased, but can’t keep up with the approximately 50% increase in rents we are seeing.

I recently read the Rhode Island Foundation-commissioned report on housing and rental affordability and the ever-growing homeless population in Rhode Island. While homeowners are basking in the rewards of increasing equity and value, those left on the sidelines are being left behind. According to the report, Rhode Island home values are among the fastest growing in the Northeast.

Gov. Dan McKee and the General Assembly leadership, to their credit, in this recent legislative session created a new Rhode Island Department of Housing and allocated a $250 million budget, which is a start, but nowhere near enough to fix this ever-growing problem. According to the report, unsheltered homelessness in Rhode Island has grown 56% per year since 2020, the second-highest growth rate across states. The governor appointed and the Senate confirmed Stefan Pryor, the former R.I. commerce secretary and Connecticut’s former education secretary to tackle this problem. He is a hard charging, can do, take no prisoners government leader who knows how to make decisions and get the job done. But he is but one man, with a small staff, up against this ever-spiraling upward housing market, which every month, month after month, puts more pressure on housing affordability, rent affordability and the burgeoning homeless population.

Don’t be surprised if legislators start to rattle the sabers for rent control, as their constituents are unable to afford current rents. Or that the governor and General Assembly leadership propose a tax on sellers to help finance government-sponsored housing programs to level the playing field. Something must give. These increases cannot continue unabated much longer, without some government pushback, with ramifications for homeowners and taxpayers.

Douglas Gablinske owns AppraiseRI, a 27-year-old real estate company locate din Bristol, R.I. He is chairman of the Warren Taxpayer Appeal Board and was recently appointed to serve on the Rhode Island Real Estate Appraisal Board. He can be reached at Doug@AppraiseRI.biz.

Other items that may interest you