Top lawmakers approve governor’s $300 million borrowing request

Raimondo: ‘We have to keep the lights on to keep Rhode Islanders alive’

Posted

Editor's note: This story appears on our website as part of a partnership between East Bay Media Group and Beacon Communications to share coverage of the COVID-19 crisis.

The General Assembly’s four-member Disaster Emergency Funding Board on Thursday approved Gov. Gina Raimondo’s request for authority to borrow up to $300 million – a move the administration says is needed to maintain Rhode Island’s cash flow amid the effects of the COVID-19 crisis.

“Our revenues have really taken a plunge … It’s my top goal to reopen the economy, but at the moment, we are facing a liquidity problem. We don’t have the liquidity we need,” Raimondo told the panel.

General Treasurer Seth Magaziner said as standard practice, a balance of approximately $40 is consistently maintained in state’s general fund.

As a result of the current crisis – which has seen revenues drop sharply as expenses grow – he said officials are “anticipating falling below that $40 million level as soon as Monday, and the balance could fall to zero soon after that.”

Magaziner said March and early April are typically the most fallow in terms of the state general fund’s cash balance, or so-called “rainy day fund, which is traditionally maintained at approximately $200 million – or roughly 5 percent of the previous year’s revenues – at the start and end of each fiscal year and varies throughout that 12-month period. This time of year is the tightest from a fiscal standpoint, he said, because of the revenue that usually arrives with tax day in mid-April.

“Fiscally, this crisis really could not have come at a worse time,” he said.

Securing a $300 million line of credit, Magaziner added, will “ensure that in this time of crisis, the state can continue to serve the public.”

Raimondo more bluntly echoed that sentiment: “We have to keep the lights on to keep Rhode Islanders alive.”

She also said the federal government’s decision to delay the tax filing and payment deadline from April 15 to July 15 – a move the state followed – created new urgency from a cash flow perspective.

“Once that happened, it absolutely necessitated a measure of this kind,” she said.

Jonathan Womer, director of the state’s Office of Management and Budget, also spoke of “liquidity and timing of revenue” as the primary issue facing the state at this point. While the $2 trillion stimulus package on the federal level will provide relief for Rhode Island – including $1.25 billion in aid for the state – he said it will take time to fully sift through and receive that funding.

Magaziner said the state remains in negotiations over the precise terms of the borrowing, although he expects an agreement within days.

While he declined to discuss specifics related to potential lenders, he said the general contours of the talks involve a roughly 3-percent annualized interest rate and a repayment term of four to 12 months.

“This is a line of credit, not a tax anticipation note … We will have the option of only drawing as much as we need, when we need it,” he added.

The request received the unanimous backing of the rarely convened Disaster Emergency Funding Board, which includes House Speaker Nicholas Mattiello of Cranston, Senate President Dominick Ruggerio of North Providence, House Finance Chairman Marvin Abney of Newport and Senate Finance Chairman William Conley of East Providence.

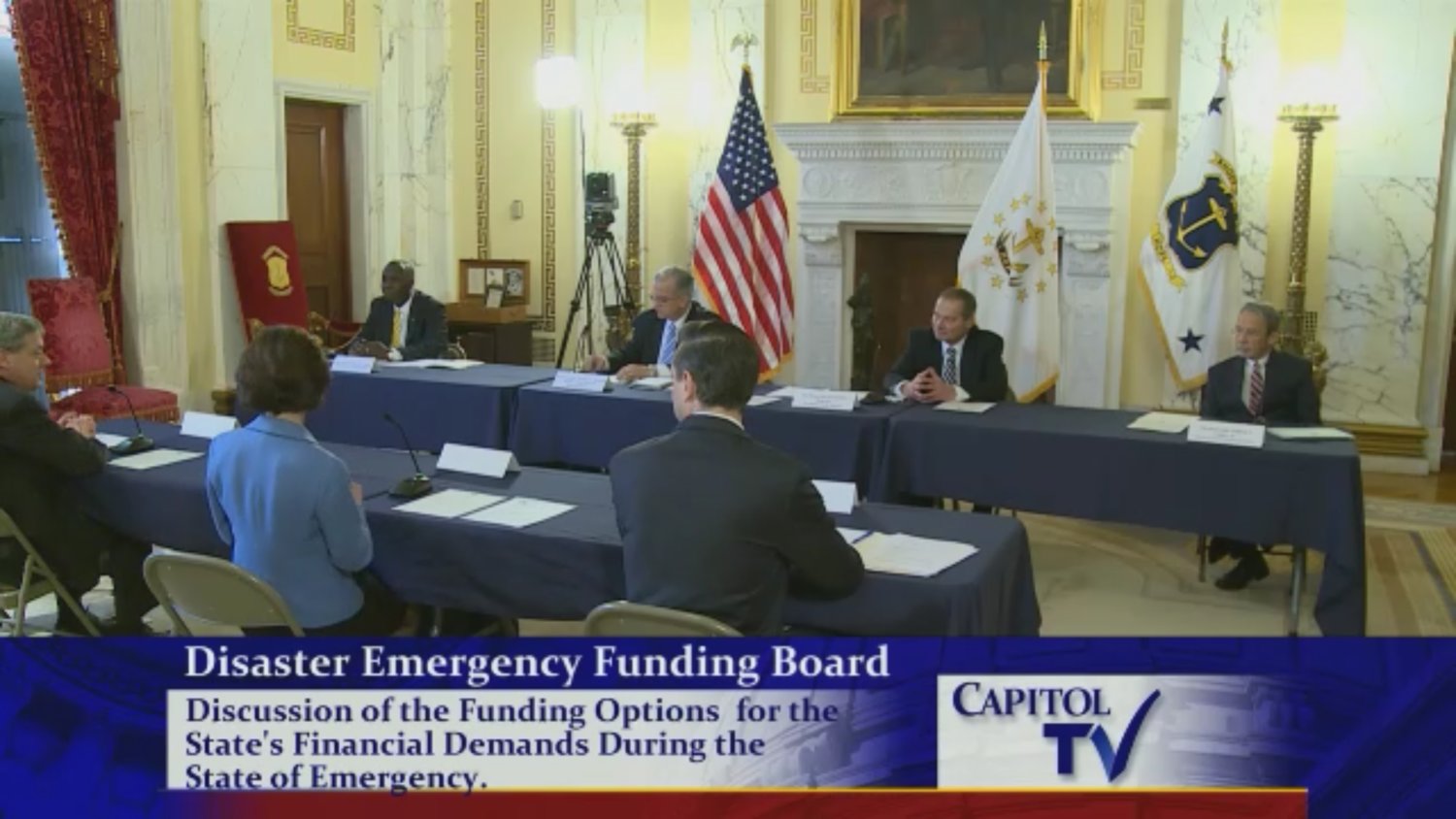

While the proceedings – which took place in the State Room at the State House and were broadcast via Capitol TV – were unusual, the lawmakers uniformly sought to reassure residents and dispel questions regarding the process being utilized.

“We’re not rewriting the budget,” Abney said, later added: “If I thought it was a bad deal, I wouldn’t sign it … I’ll be watching every day, every second.”

Conley described the communication among the governor’s office, the General Assembly’s leadership and various state departments as “extraordinary, consistent with the extraordinary times and challenge we’re facing.”

Addressing the governor, he added: “Because of the comprehensive nature of the information you’ve shared with us, because of the level of communication you’ve engaged in with us … I feel confident that this has been vetted as much as any financial document or study that I’ve been involved with during my service in the Senate.”

Conley also cited “guardrails” in the resolution approved Thursday that will limit the use of loan funding to supporting cash flow and provide for reporting and oversight requirements.

Mattiello said Rhode Islanders “can be very secure in the notion that we are not creating any new spending.” Describing the decline in revenues and jump in expenses related to the crisis as a “clash of the worst possible set of circumstances,” he said the “normal tools don’t work under these set of circumstances.”

“If you’d told me two or three months ago this was going to happen, I just would not believe it … In light of that, I am very comfortable moving forward with an extraordinary resolution to that extraordinary problem,” he said.

Speaking to Raimondo and Department of Health Director Dr. Nicole Alexander-Scott, Mattiello added: “Your judgment’s been very good on behalf of Rhode Islanders.”

Ruggerio added: “I want to thank you for the great job you’ve done … I think you’ve lent a lot of comfort to a lot of Rhode Islanders during these difficult times.”

Others, however, are critical of the borrowing plan, questioning the constitutionality of going through the Disaster Emergency Funding Board rather than a standard legislative vetting process.

In a statement March 24, Rhode Island GOP Chairwoman Sue Cienki said legal action is being considered.

On Thursday, she issued another statement that reads, in part: “Rhode Island’s fiscal health was already in poor health before the coronavirus put it into critical condition. Circumventing the constitution, faulty projections, and bad fiscal management by State House politicians will now cost Rhode Islanders millions more in debt.”