Lack of diversity drives Barrington's top tax bills

Almost entirely dependent on single-family taxpayers, Barrington has the highest household tax burden in Rhode Island

The residents of Barrington are used to superlatives. Best public schools in the state. Great place to live. Beautiful coastline.

They can add another – highest household tax burden in Rhode …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Lack of diversity drives Barrington's top tax bills

Almost entirely dependent on single-family taxpayers, Barrington has the highest household tax burden in Rhode Island

The residents of Barrington are used to superlatives. Best public schools in the state. Great place to live. Beautiful coastline.

They can add another – highest household tax burden in Rhode Island.

The label is not surprising. This has been an expensive place to live for generations, known for the connection between its great schools and high taxes. Yet there is more to the story than just the cost of schools. In fact, the schools don’t have as much of an impact on the household tax burden as most people would assume.

A Barrington Times analysis last year showed that Barrington has the second-lowest per-pupil education cost in Rhode Island — ahead of only Woonsocket. That’s because Barrington has one of the densest student populations in the state. So while the cost of education is high in Barrington, measured on a per-pupil basis, it is exceptionally low.

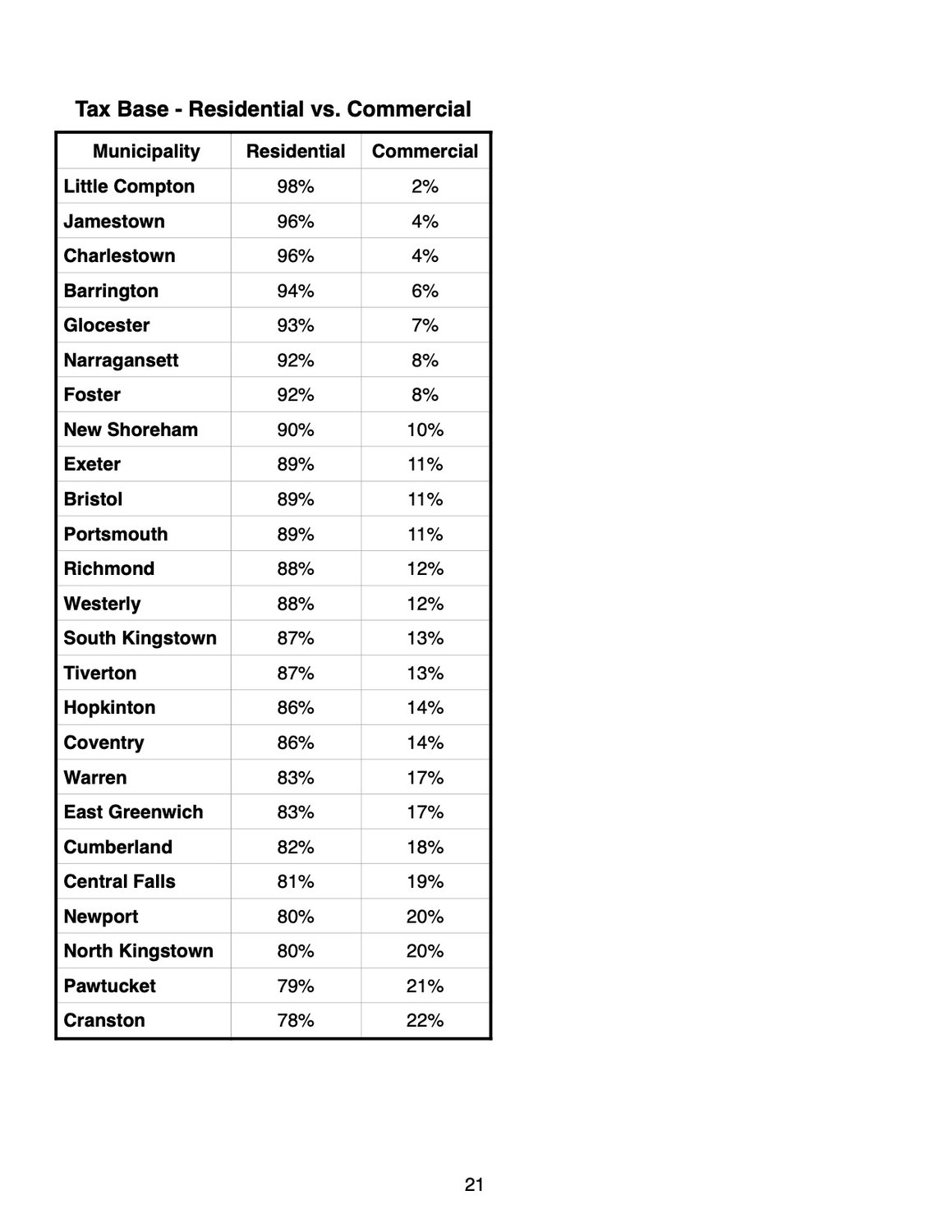

The biggest driver of high tax bills in Barrington is the lack of diversity in its tax base. Barrington has one of the most homogenous tax bases anywhere, with 94% of the town’s tax base classified as residential and 6% as commercial. Here in Rhode Island, only three rural or sparsely populated communities, Little Compton, Jamestown and Charlestown, have less diverse tax bases.

Consider the difference between Barrington and its frequent West Bay comparison, East Greenwich. The community with the other top-rated school district in the state has a tax base that is 83% residential, 17% commercial. In fact, in a ranking of Rhode Island’s 39 cities and towns by Residential tax base as a percentage of the total tax base, East Greenwich is exactly in the middle — 20th.

Residents carry the burden

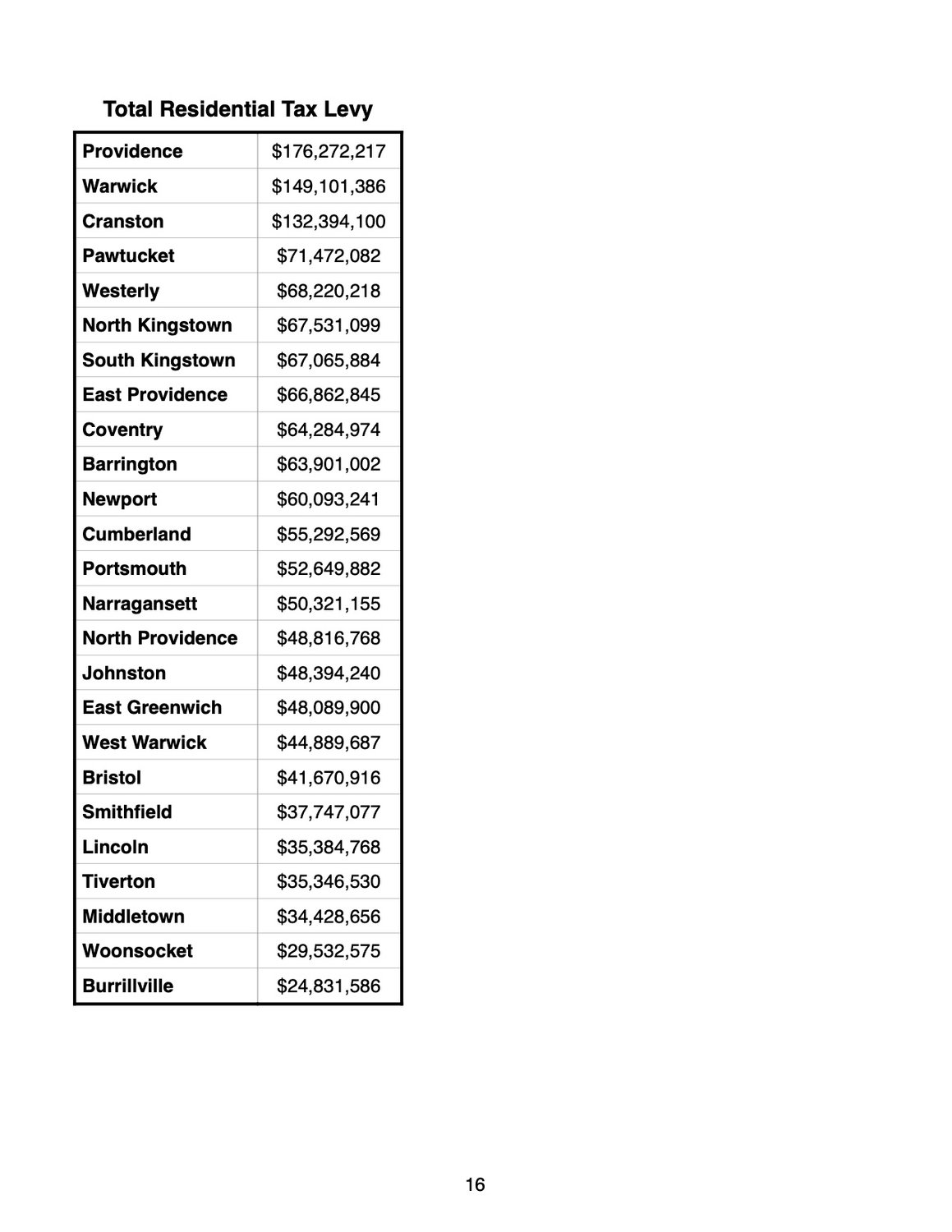

Because of the town’s one-dimensional tax structure, Barrington households pick up the vast majority of the tab for public services. This fiscal year, the residential tax levy (property taxes + motor vehicle taxes) is nearly $64 million. The commercial tax levy (property taxes + tangible taxes) is just $3.7 million. [Note: These figures were drawn from the R.I. Division of Taxation and do not include Sewer Use fees. Barrington households pay an additional $4 million per year in Sewer fees, on top of the $64 million noted above.]

Contrast the Barrington tax burden with East Greenwich once again. Residents there pay about $48 million, and businesses pay about $12 million — an 80/20 split.

Or consider North Kingstown, another comparable suburban district with top schools. Residents of that South County community pay a similar $67 million in residential taxes, but their large commercial sector adds $17 million to the annual town budget — a 79/21 split.

There are obvious reasons for Barrington’s homogenous tax base. A long history of decisions by town planners, zoners and developers, combined with that consistently good school system and beautiful coastline, drove a massive housing build-out through the second half of the 20th century. Whatever industry existed in Barrington has been gone for decades. And quirky rules, like the town’s long-held ban on liquor licenses, tamped down some commercial growth.

The result today is a town almost entirely built into single-family residences. Aside from a couple of commercial corridors along County Road and Maple Avenue, nearly all the land in Barrington has been either preserved or turned into house lots. In other words, the 94% residential tax structure is not likely to change much — ever.

Highest tax bill per household

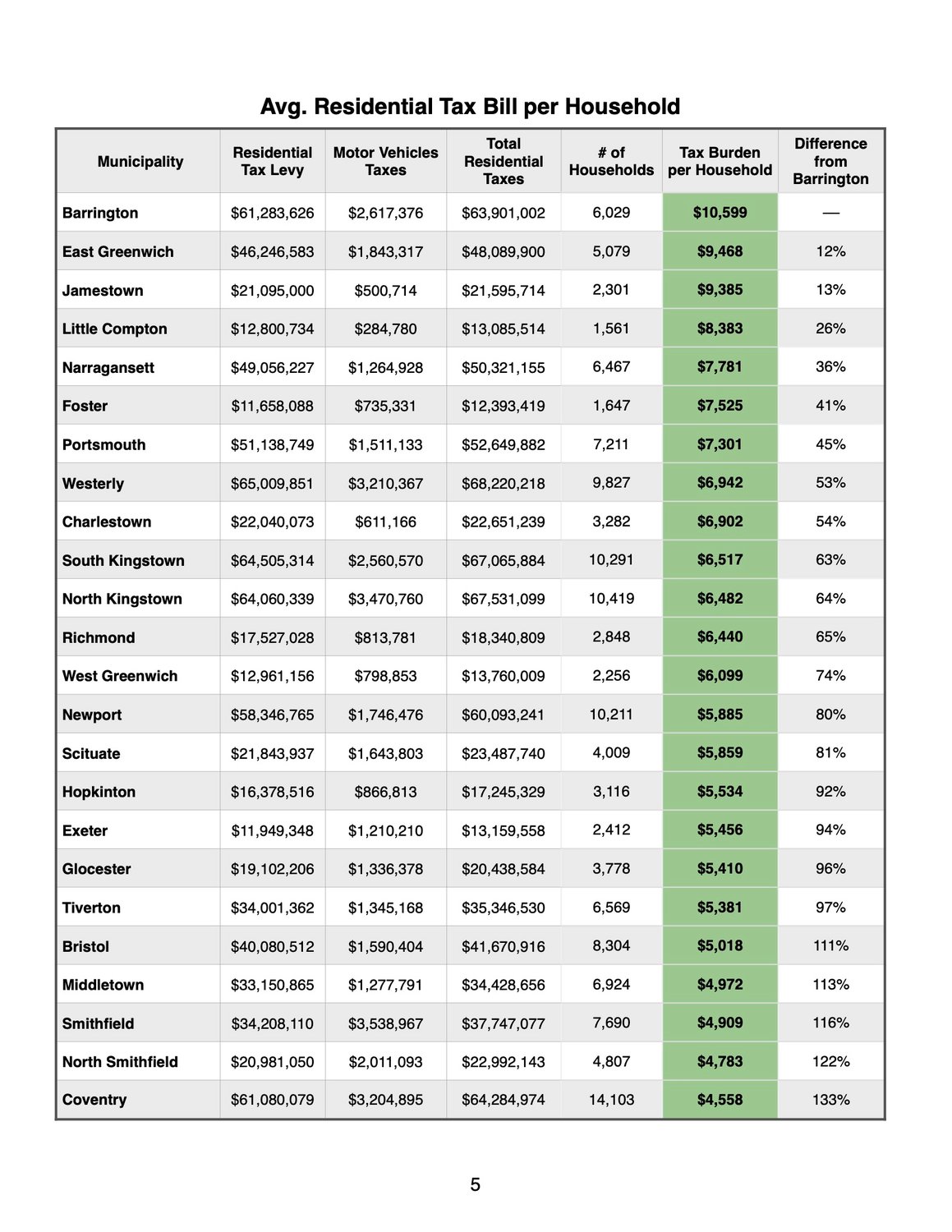

The average household tax bill in Barrington is $10,599 per year. Next-highest in Rhode Island is East Greenwich, with an average household tax burden of $9,468. So Barrington households carry a tax burden that is, on average, 12% higher than the next closest community.

Narragansett has nearly the same number of households as Barrington (both have between 6,000 and 6,500 homes), but about one-third the number of school students, plus a 90/10 split between residential and commercial properties. Thus Narragansett households carry an average household tax burden that, even though it is fifth-highest in Rhode Island, at $7,781 per year, is still 36% lower than Barrington’s.

North Kingstown has 4,000 more households than Barrington, plus that dramatically different tax base (20% commercial), and its households carry an average tax burden of $6,482 — 64% lower than Barrington’s.

There is no smoking gun in this analysis of Barrington’s tax structure. Several generations of development and decisions built a community that is overwhelmingly residential, oriented around its schools, and blessed with magnificent vistas. As such, it is also overwhelmingly reliant on its residential taxpayers to fund the vast majority of public services — something that becomes most visible during the annual budgeting process, and when large capital projects loom.